EIA report shows declines in stock supplies across the board.

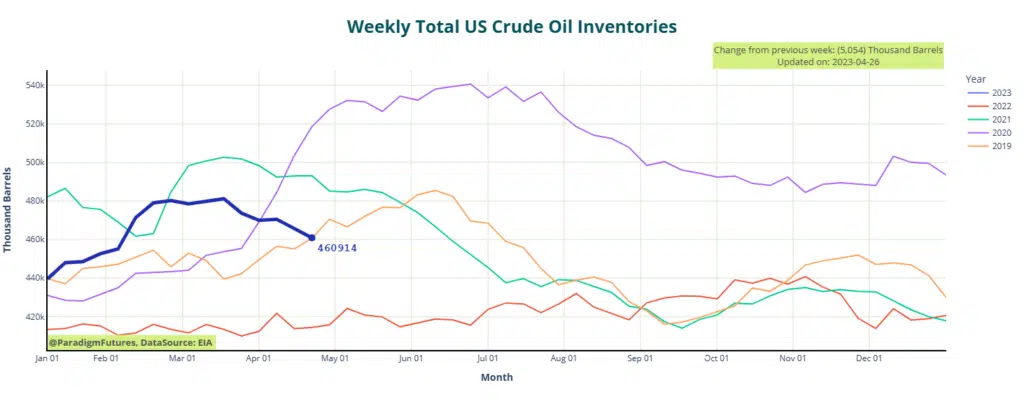

Energy Information Administration reports an inventory draw of 5.1 million barrels for the week to April 21. This compared with another decline of 4.6 million barrels, for the previous week, and an estimated 6-million-barrel inventory decline for the week to April 21, as reported by the American Petroleum Institute.

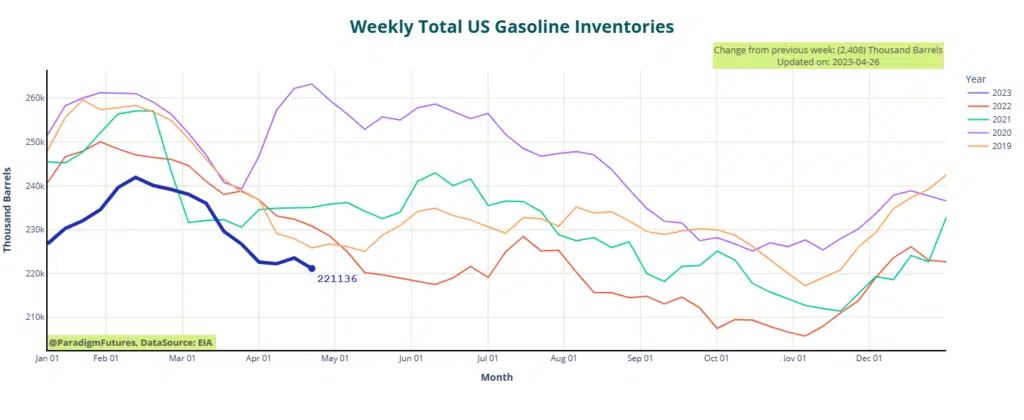

The EIA also reported a decline in gasoline inventories and a smaller draw in middle distillate inventories. Gasoline inventories shed 2.4 million barrels last week, which compared with an inventory build of 1.3 million barrels for the previous week.

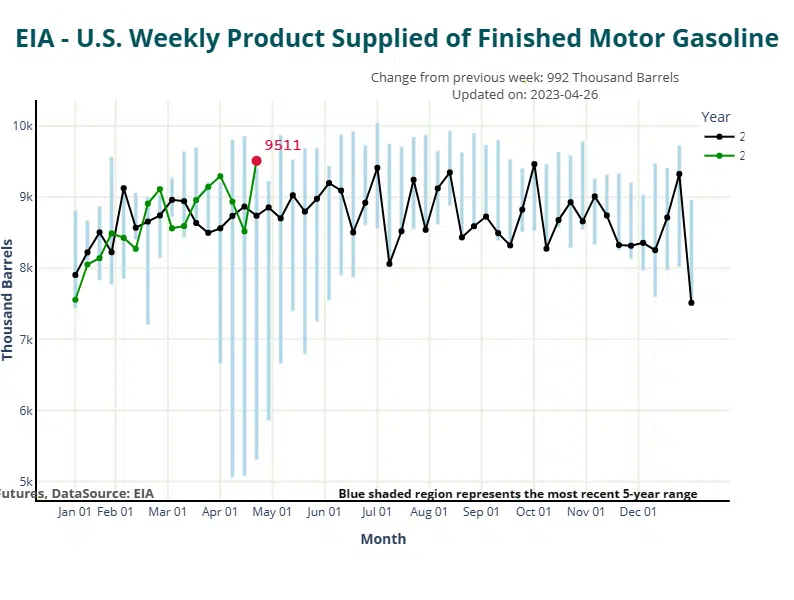

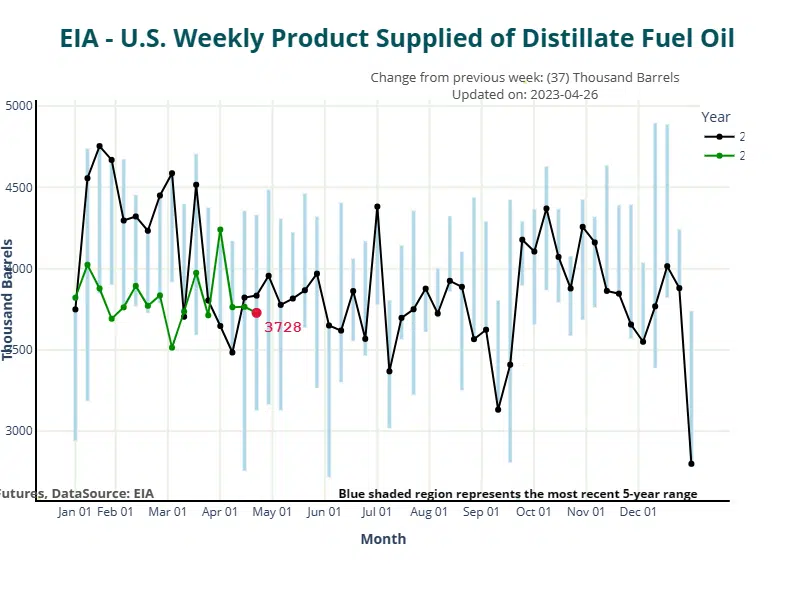

Last week, gasoline production increased to an average of 10 million bpd, compared to 9.5 million bpd the previous week. The EIA estimated a draw of 600,000 barrels in middle distillates inventory for the week ending April 21, with a daily production average of 4.7 million barrels. In the previous week, inventory draw was 400,000 barrels, and average daily production was 4.8 million barrels. Refineries in the United States operated at 91.3% of capacity, processing an average of 15.8 million barrels daily

On Tuesday, the API’s estimated larger than expected decline in inventories did not positively affect prices, but earlier today, the report drew traders’ attention to the supply side of the oil market, leading to climbing prices. However, concern about demand remained capped any potential gains after Treasury Secretary Janet Yellen called on Congress to raise or suspend the debt ceiling to avoid an “economic catastrophe.” The Treasury Secretary stated on Tuesday that a default on the debt would produce an economic and financial catastrophe

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results.