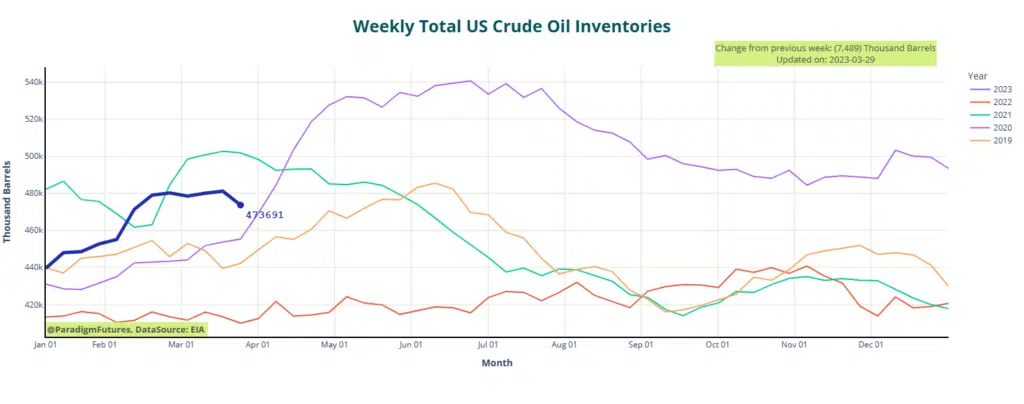

- Crude Inventories 🔽7.5 M bls

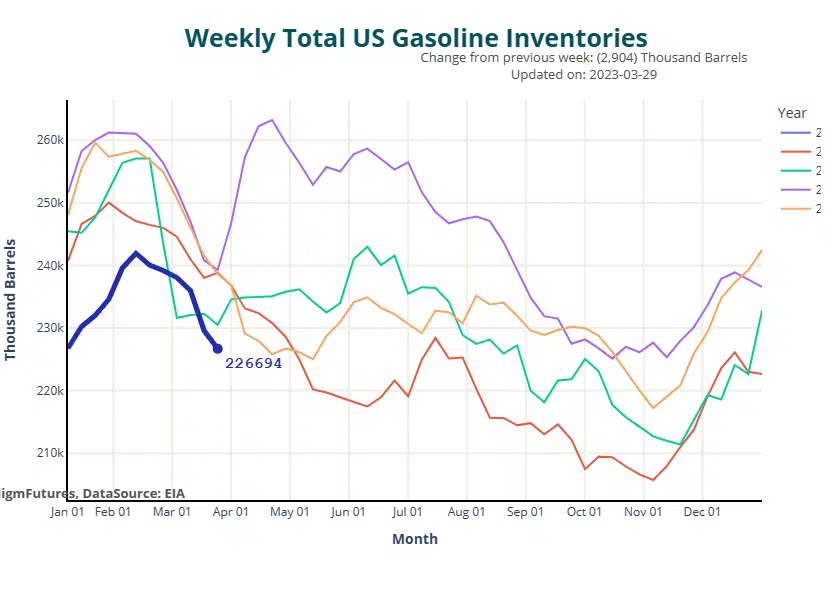

- Gasoline 🔽2.9 M bls

- Distillates 🔺300k bls

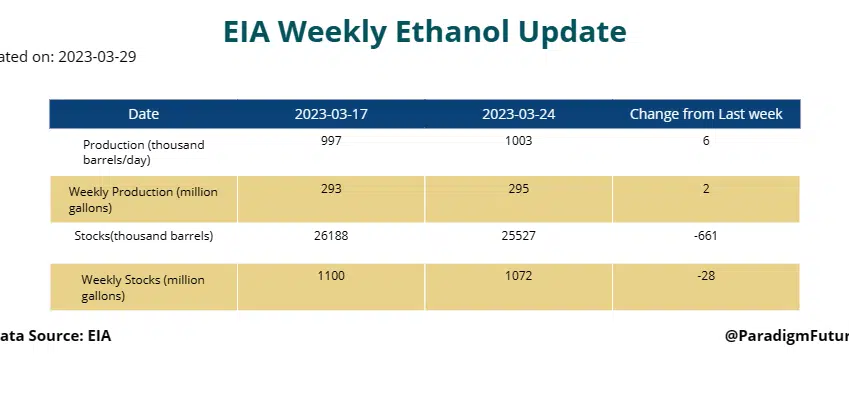

- Ethanol 🔽28M Gal

- SBR ⛔ No Change

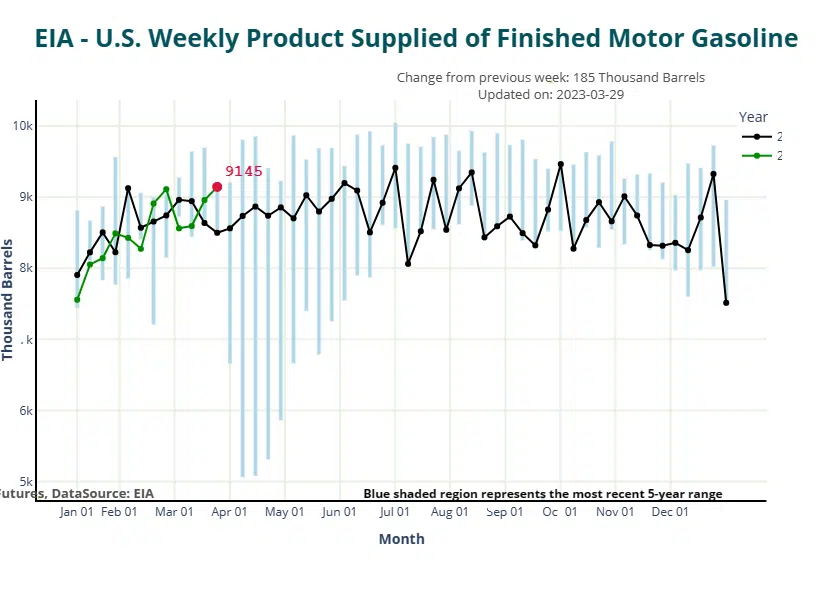

After fairly consistent builds, US Crude stocks see a good size draw. The Energy Information Administration on Wednesday reported that crude inventories fell by 7.5 million barrels for the week ended March 24. On average, analysts forecast a decline of 5.5 million barrels, according to a survey by S&P Global Commodity Insights. The EIA report showed a weekly inventory decline of 2.9 million barrels for gasoline, while distillate supplies edged up by 300,000 barrels. The analyst survey had forecast supply decreases of 4.8 million barrels for gasoline and 2 million barrels for distillates. Crude stocks at the Cushing, Okla., Nymex delivery hub fell by 1.6 million barrels for the week, the EIA said. May West Texas Intermediate crude was up $1.01, or 1.4%, at $74.21 a barrel on the New York Mercantile Exchange, little changed from before the data release.

Gasoline inventories fell by 2.9 million barrels in the reported period, which compared with a draw of 6.4 million barrels for the previous week.

Gasoline production stood at an average 10 million barrels daily last week, compared with 9.5 million barrels daily for the previous week.

In middle distillates, the EIA reported an inventory increase of 300,000 barrels for the week to March 21. This compared with a draw of 3.3 million barrels for the previous week.

Middle distillate production averaged 4.6 million barrels daily, which compared with 4.5 million barrels daily a week earlier.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results.