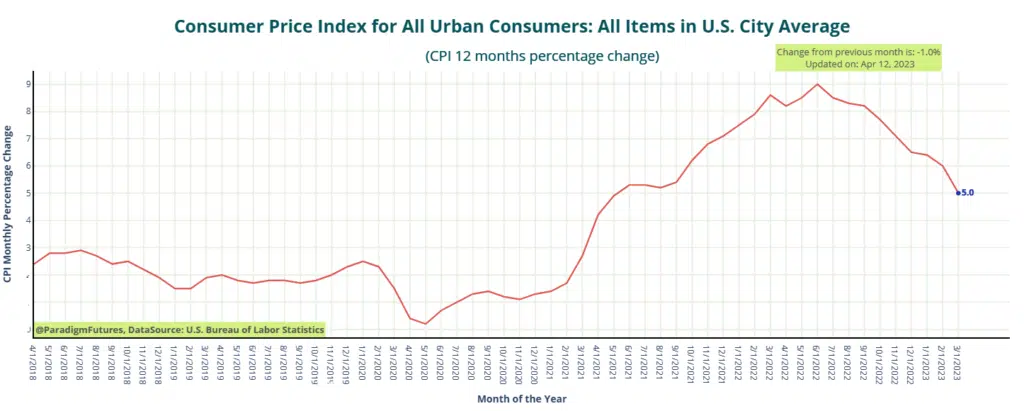

Critical CPI Data ahead of the release of the FOMC minutes shows a drop in Headline YoY

Headline Inflation 5 %

Core Inflation 5.6%

▪️Annual US CPI (March): 5.0% Expected: 5.2% Previous: 6.0% Monthly

▪️US CPI (March): 0.1% Expected: 0.2% Previous: 0.4%

▪️US Core CPI YoY: 5.6% (forecast 5.6%, prior 5.5%)

▪️US Core CPI MoM: 0.4% (0.4% forecast, 0.5% prior)

Other Key Developments

The International Monetary Fund’s updated global forecasts released on Tuesday show a pretty benign base case, despite warnings about financial sector disturbance and a plethora of ‘ifs and ‘buts’. Growth expectations for this year have been shaved by just a tenth compared to January, at 2.8%. The IMF has revised up its core inflation outlook and, in fact, lifted its U.S. growth outlook for 2023 and 2024 to 1.6% and 1.1%, respectively.

Regardless of what the FOMC decides to do in it’s next meeting, One key data point to note is the Feds balance sheet. While the press statements say that they are still “fighting inflation” and many expect another 25bps hike, if you look at the increases in the Feds balance sheet from 3/1 til today; and it would appear that we have already seen the Fed pivot from QT. So is it still QE if you don’t call it that?

We have not yet experienced the widely feared recession, despite the deepest yield curve inversion in more than 40 years between 3-month paper and 10-year notes. However, rising speculative short positions in S&P 500 futures suggest that many hedge funds are already braced for a stock reversal, and the burden of proof on a recession may be rising.

Cash holdings in money market funds have also soared by more than $350 billion since before the banking mini-meltdown last month, even though fears of systemic contagion have subsided. While much of that money may stay there for near-5% interest rate returns, some may rebalance back into wider markets.

The rest of the week is likely to provide more insight and volatility as we await tomorrows’ PPI report and earnings reports due up from BlackRock, Citigroup, JPMorgan Chase, PNC Financial and Wells Fargo.